A car accident can turn your world upside down in seconds. Between the shock, confusion, and adrenaline, it’s easy to make decisions that could hurt your health, your finances, or your legal claim later. Understanding the common mistakes after a car accident is the first step toward protecting yourself.

In Oregon, where unpredictable weather and busy roads lead to thousands of collisions each year, knowing what not to do after an accident can be just as important as knowing what to do. According to the Oregon Department of Transportation, over 55,000 traffic crashes occur annually in the state, with many victims unknowingly compromising their claims through preventable errors.

If you’ve been injured in a collision, understanding the dos and don’ts following a car accident can make a significant difference in your recovery.

Also Read

- Do I need to get a lawyer for a wreck that was my fault?

- Driving without auto insurance

- What to do if you were hit by a car while riding your bike

TL;DR

After a car accident in Oregon, avoid these critical mistakes: leaving the scene prematurely, skipping the police report, admitting fault, delaying medical care, failing to collect evidence, speaking unprepared to insurers, posting on social media, settling too quickly, missing filing deadlines, and handling everything alone. Each mistake can significantly reduce your compensation or eliminate your claim entirely. Proper documentation, timely medical attention, and legal guidance protect your health and financial recovery.

Key Takeaways

- Stay at the scene and fulfill all legal obligations to exchange information and report the accident to authorities.

- Get a police report even for minor accidents, as it provides crucial documentation for insurance and legal claims.

- Seek immediate medical attention to identify delayed injuries and create essential documentation for your claim.

- Document everything thoroughly including photos, witness information, and all accident details before leaving the scene.

- Consult an attorney before accepting settlement offers or making recorded statements to insurance companies.

Mistake #1 — Leaving the Scene Too Soon

Staying at the accident scene isn’t just common courtesy—it’s a legal requirement that protects everyone involved. Many accident victims, especially after minor collisions, feel tempted to leave quickly to avoid traffic or embarrassment. This decision can have serious consequences.

Oregon law requires drivers involved in any accident resulting in injury, death, or property damage to remain at the scene. Under ORS 811.700, leaving the scene of an accident is a criminal offense that can result in fines, license suspension, or even jail time depending on the severity.

Beyond legal penalties, leaving early creates gaps in documentation that insurance companies will use against you.

What You Must Do at the Scene

When an accident occurs, you’re legally obligated to exchange specific information with other parties. This includes your name, address, vehicle registration number, and insurance information. You must also provide reasonable assistance to anyone injured, including arranging for medical care if needed.

If the other driver leaves or refuses to cooperate, document everything you can. Take photos of their vehicle and license plate if possible, note the direction they traveled, and immediately call the police. Oregon law enforcement takes hit-and-run cases seriously, and a prompt report increases the chances of locating the responsible party.

How Leaving Early Complicates Your Claim

Insurance companies investigate accidents thoroughly. If you leave before police arrive or before completing information exchange, insurers may question your account of events. This gap in documentation makes it harder to prove the other driver’s negligence and can result in claim denials or reduced settlements.

Additionally, witnesses who could corroborate your version of events may disappear. Road conditions change, and critical evidence like skid marks or debris gets cleared away. Staying at the scene ensures you have time to gather comprehensive evidence while it’s still available.

Mistake #2 — Not Calling the Police

Many people believe police reports are only necessary for serious accidents involving injuries or major vehicle damage. This misconception leads to one of the most common mistakes after a car accident. Even seemingly minor fender-benders deserve official documentation.

A police report creates an independent, third-party record of the accident. The responding officer will document the scene, interview witnesses, note weather and road conditions, and often make preliminary determinations about fault. This official documentation carries significant weight with insurance companies and in court.

Why Official Documentation Matters

Insurance adjusters rely heavily on police reports when evaluating claims. These reports provide objective details that can’t be disputed later. Without a police report, the accident becomes a “he said, she said” situation where proving your version of events becomes exponentially harder.

According to the Insurance Information Institute, claims with police reports are processed 40% faster than those without official documentation. The report establishes a clear timeline, identifies all parties involved, and preserves witness statements that might otherwise be lost.

What to Verify Before Leaving

After the officer completes their report, ask to review the information they’ve recorded. Verify that your statement was accurately documented and that all visible damage to your vehicle is noted. If you notice errors or omissions, request corrections immediately.

Get the officer’s name, badge number, and the report number for your records. This information will be essential when filing your insurance claim. Request a copy of the report as soon as it becomes available—typically within a few business days.

Mistake #3 — Admitting Fault or Apologizing

In the emotional aftermath of an accident, most people’s natural instinct is to apologize—even when they’re not at fault. While politeness is admirable, simple apologies can be misinterpreted as admissions of guilt that severely damage your legal claim.

Insurance companies and defense attorneys scrutinize every word you say after an accident. Statements like “I’m sorry” or “I didn’t see you” can be twisted into evidence that you accept responsibility for the collision, even if road conditions, vehicle defects, or the other driver’s actions were primarily responsible.

How to Communicate Without Compromising Your Claim

You can be respectful and check on others’ wellbeing without admitting fault. Appropriate statements include “Are you okay?” and “Let me call for help.” Stick to factual information when exchanging details: “Here’s my insurance information” rather than explaining what you think happened.

When speaking with the responding officer, describe what you observed without speculation. Say “The light was green when I entered the intersection” rather than “I think I might have been going too fast.” Let investigators piece together the complete picture.

Why Fault Determination Takes Time

Accidents involve multiple factors that aren’t immediately apparent. Mechanical failures, obscured traffic signals, road defects, or even the actions of a third party could have contributed to the collision. Oregon follows a modified comparative negligence rule, meaning fault can be shared among multiple parties.

Professional investigators examine physical evidence, review traffic camera footage, consult accident reconstruction experts, and analyze all available data before determining fault. Your premature admission could assign you responsibility that proper investigation would prove you don’t deserve.

Mistake #4 — Failing to Get Medical Attention

Adrenaline is a powerful chemical that masks pain and injury symptoms immediately after a traumatic event. Many accident victims feel fine at the scene, only to experience severe pain, headaches, or other symptoms hours or days later. Delaying medical attention is one of the most dangerous mistakes after a car accident.

Certain injuries like whiplash, concussions, internal bleeding, and soft tissue damage don’t present immediate symptoms. According to the National Highway Traffic Safety Administration, whiplash symptoms can appear up to 48 hours after an accident, while concussion symptoms may emerge even later.

Why Documentation Is Critical

Even if you feel fine, seeing a doctor immediately after an accident creates crucial medical documentation. This record establishes a direct link between the accident and any injuries you develop. Insurance companies routinely deny claims for injuries that appear days or weeks after an accident, arguing they must have resulted from something else.

Medical records provide objective evidence of your injuries, their severity, and their impact on your daily life. This documentation becomes essential when calculating compensation for medical expenses, lost wages, and pain and suffering.

How to Track Symptoms and Follow Through

Keep a detailed journal of any symptoms you experience after the accident, no matter how minor they seem. Document when symptoms appear, their severity, and how they affect your daily activities. This record strengthens your claim and helps your healthcare providers understand your condition.

Follow all treatment recommendations from your healthcare providers. Missing appointments or stopping treatment prematurely gives insurance companies ammunition to argue your injuries weren’t serious. Complete your full treatment plan, even if you start feeling better.

Mistake #5 — Not Collecting Enough Evidence

The moments immediately following an accident are your best opportunity to preserve evidence. Once you leave the scene, that opportunity is largely gone. Thorough documentation can make the difference between a successful claim and a denied one.

Modern smartphones have made evidence collection easier than ever. Use your phone’s camera to document everything from multiple angles. The more comprehensive your documentation, the stronger your position in insurance negotiations or court.

Essential Evidence to Gather

Photograph all vehicles involved from multiple angles, capturing visible damage, license plates, and their final positions. Take wide shots showing the overall accident scene, including traffic signals, road signs, skid marks, and debris patterns. Document road conditions, weather, and lighting conditions.

Get contact information from all witnesses, including their names, phone numbers, and email addresses. Ask if they’re willing to provide a statement. Independent witness testimony can be invaluable if the other driver disputes your account.

Why Small Details Matter

Details that seem insignificant at the scene can become critical later. Skid marks indicate speed and braking patterns. Damage patterns reveal impact angles and force. Road conditions like ice, potholes, or faded lane markings can establish contributing factors.

Insurance adjusters and attorneys examine every detail when investigating claims. They look for inconsistencies between accounts or evidence of factors that affected fault. The National Safety Council recommends creating an accident documentation checklist to keep in your vehicle, ensuring you don’t overlook crucial details during the stress of an accident.

Using Technology Effectively

Beyond photos, consider recording a voice memo describing what happened while details are fresh in your mind. Note the time, date, and exact location. If your vehicle has a dashcam, preserve that footage immediately.

Many insurance companies now offer mobile apps that guide you through the documentation process. These tools can help ensure you collect all necessary information. However, don’t rely solely on insurance apps—keep your own comprehensive records.

Mistake #6 — Talking to Insurance Companies Without Preparation

Within hours of an accident, you’ll likely receive calls from insurance adjusters—both your own company and the other driver’s insurer. These conversations feel casual and helpful, but insurance adjusters work to minimize their company’s payout. What you say during these calls can significantly impact your settlement.

Insurance companies train adjusters to use specific tactics that encourage claimants to undervalue their injuries or inadvertently accept partial fault. They’ll ask you to provide recorded statements, request access to your medical records, and push for quick settlements before you understand the full extent of your injuries.

Common Insurance Adjuster Tactics

Adjusters often call when you’re still shaken up, hoping you’ll provide inconsistent statements or make damaging admissions. They may ask leading questions like “You were in a hurry, weren’t you?” or “You didn’t see the other car because you were distracted, right?” These questions are designed to elicit responses that shift blame to you.

Another common tactic involves requesting a recorded statement about the accident. While you must cooperate with your own insurance company, you’re not legally required to provide recorded statements to the other driver’s insurer. These recordings can be used against you later, especially if your memory of events changes as shock wears off.

What to Say—and What Not to Say

When speaking with any insurance company, stick to basic facts. Provide the date, time, and location of the accident. Describe what happened in simple, factual terms without speculation. If you don’t remember something or aren’t sure, say so—don’t guess. Following proper insurance tips before and after an accident can help you navigate these conversations more effectively.

Never discuss your injuries in detail during initial calls. Your full medical situation may not be clear for days or weeks. Saying “I feel fine” in the first call can be used to dispute injury claims later, even if you develop serious symptoms afterward.

When to Consult an Attorney

Consider speaking with a personal injury attorney before signing any documents or accepting any settlement offers. Many attorneys offer free consultations where they can review your situation and advise whether you need legal representation.

An attorney can handle communications with insurance companies on your behalf, protecting you from tactics designed to reduce your settlement. They understand the true value of your claim and can negotiate effectively on your behalf.

Mistake #7 — Posting About the Accident on Social Media

Social media has become a part of daily life, and many people instinctively share major life events online. However, posting about your accident on Facebook, Instagram, Twitter, or any other platform can seriously damage your legal claim.

Insurance companies and defense attorneys routinely monitor claimants’ social media accounts, looking for posts, photos, or comments that contradict injury claims. Even seemingly innocent posts can be taken out of context and used against you.

What Insurers Look For Online

Adjusters search for any content suggesting your injuries are less severe than claimed. A photo of you smiling at a family gathering can be used to argue you’re not experiencing pain and suffering, even if you were miserable five minutes after the photo was taken.

Posts about the accident itself can also cause problems. Describing what happened online creates a public record that might contradict your official statements. Comments from friends, even sympathetic ones, can introduce information that complicates your case.

Safe Online Habits After an Accident

The safest approach is to avoid posting anything about the accident, your injuries, or your daily activities until your claim is resolved. Set your social media accounts to private and decline friend requests from people you don’t know—these could be investigators.

Don’t delete existing posts or deactivate accounts, as this can be viewed as destruction of evidence. Simply refrain from posting new content related to the accident. Remember that “private” settings aren’t foolproof—mutual friends might share your posts, or your privacy settings might not be as restrictive as you think.

According to the American Bar Association, social media content is now used in over 90% of personal injury cases. One careless post can reduce your settlement by thousands of dollars or eliminate your claim entirely.

Mistake #8 — Settling Too Quickly

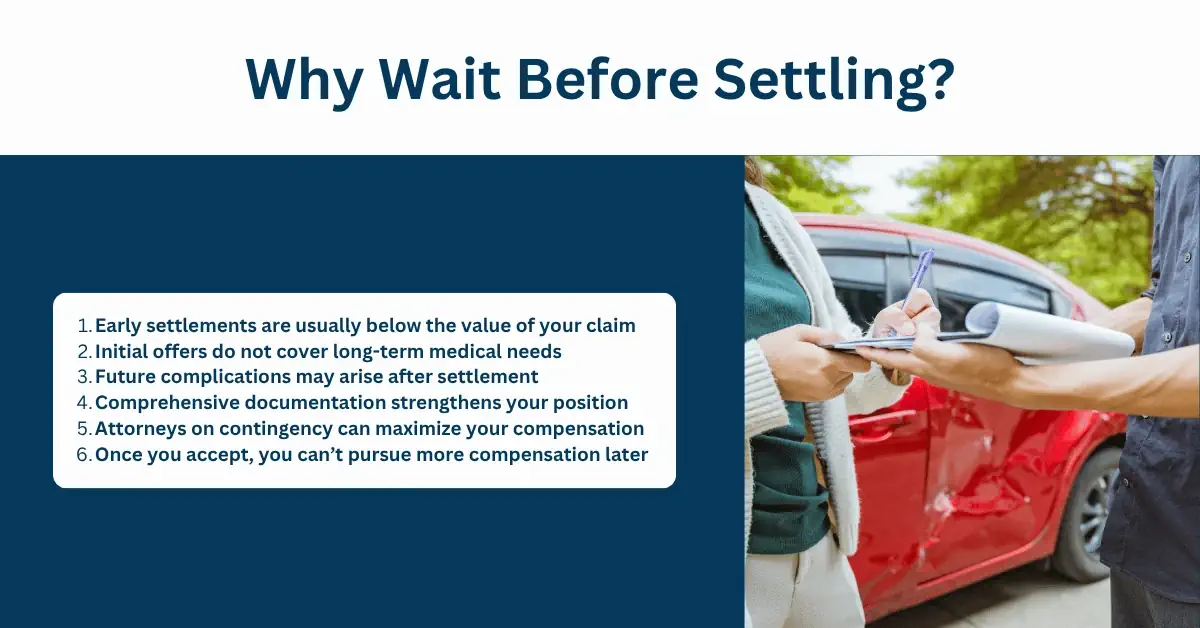

After an accident, you’ll face mounting medical bills, vehicle repair costs, and possibly lost wages from missed work. When the insurance company offers a settlement, accepting that money quickly can seem like the solution to your financial stress. However, early settlement offers are typically far below what your claim is truly worth.

Insurance companies know that many accident victims are financially vulnerable after a collision. They exploit this vulnerability by making quick, low-ball offers before victims understand the full extent of their injuries and losses. Once you accept a settlement and sign a release, you cannot pursue additional compensation later—even if your injuries turn out to be more serious than initially believed.

Why Initial Offers Are Inadequate

Early settlement offers typically cover only immediate expenses like initial medical bills and basic vehicle repairs. They rarely account for ongoing medical treatment, future complications, lost earning capacity, or pain and suffering. The true cost of your accident may not become clear for months.

Some injuries require long-term treatment or result in permanent disabilities. Accepting an early settlement means you absorb all future costs yourself. For example, what seems like minor back pain immediately after an accident could require surgery six months later—surgery the settlement won’t cover.

Understanding Your Complete Losses

Before considering any settlement, you need a comprehensive understanding of your damages. This includes all past and future medical expenses, lost wages, reduced earning capacity, property damage, and non-economic damages like pain and suffering.

Work with your healthcare providers to understand your treatment prognosis. Will you need physical therapy? Surgery? Ongoing care? Your attorney can consult with medical experts to project future medical costs and ensure any settlement accounts for these expenses.

How Patience Increases Settlement Value

Insurance companies increase their offers when faced with well-documented claims and patient claimants who understand their claim’s value. As your medical treatment progresses and evidence accumulates, your negotiating position strengthens.

Most personal injury attorneys work on contingency, meaning they only get paid if you receive a settlement. This aligns their interests with yours—they’re motivated to maximize your compensation. They can advise when an offer is fair and when continued negotiation would yield better results.

Mistake #9 — Not Understanding Oregon’s Statute of Limitations

Legal deadlines, known as statutes of limitations, govern how long you have to file a lawsuit after an accident. In Oregon, these deadlines are strict, and missing them means permanently losing your right to seek compensation, regardless of how strong your case might be.

For most car accident personal injury claims in Oregon, you have two years from the date of the accident to file a lawsuit. This might seem like plenty of time, but these two years pass quickly when you’re focused on medical treatment and recovery.

Understanding the Filing Deadline

The two-year clock begins ticking on the date of your accident. If you don’t file a lawsuit within this timeframe, the court will dismiss your case. There are no extensions for being too busy, not knowing about the deadline, or thinking you could settle without going to court.

It’s important to understand that the statute of limitations applies to filing a lawsuit, not to settling your claim. Most cases settle before reaching court, but you need the threat of litigation as leverage in settlement negotiations. Once the deadline passes, insurance companies know you have no leverage and can simply refuse to pay.

Exceptions That Could Change Your Deadline

Certain circumstances can modify the standard two-year deadline. If the accident victim is a minor, the clock typically doesn’t start until they turn 18. If you’re pursuing a claim against a government entity, you may have much shorter notice requirements—sometimes as little as 180 days.

If the at-fault driver leaves Oregon after the accident, the time they’re absent might not count toward the statute of limitations. However, these exceptions are complex and fact-specific. Don’t assume an exception applies to your case without consulting an attorney.

Why Acting Promptly Protects Your Rights

Even if you have time remaining before the deadline, waiting too long creates practical problems. Witnesses’ memories fade, evidence disappears, and your own recollection becomes less reliable. The strongest claims are built on fresh evidence and prompt action.

Starting the legal process early also demonstrates to insurance companies that you’re serious about pursuing compensation. This often leads to better settlement offers without needing to actually file a lawsuit.

Mistake #10 — Trying to Handle Everything Alone

After an accident, you’re suddenly managing insurance claims, medical appointments, vehicle repairs, lost work time, and possibly a legal case—all while recovering from injuries. Many people try to handle all of this alone, either to save money on attorney fees or because they underestimate the complexity of the process.

The reality is that insurance companies have teams of adjusters, lawyers, and investigators working to minimize payouts. Facing these resources alone puts you at a severe disadvantage. What seems like a straightforward claim often involves complex legal and medical issues that determine whether you receive fair compensation.

The Hidden Complexity of Claims

Every car accident claim involves multiple areas of law: traffic law, insurance law, personal injury law, and sometimes product liability or premises liability. Understanding how these areas interact requires years of study and experience. Without this knowledge, you can easily make mistakes that reduce or eliminate your compensation.

Medical billing adds another layer of complexity. Healthcare providers may have liens on your settlement for unpaid bills. Medicare, Medicaid, or health insurance companies may claim reimbursement rights. Navigating these liens requires specific expertise to ensure you don’t end up owing more than you receive.

When Legal Guidance Makes Sense

Consider consulting an attorney if your accident involved significant injuries, disputed fault, multiple parties, a commercial vehicle, or if the insurance company denies your claim. Understanding why an injury attorney is essential can help you make an informed decision about whether you need legal representation. An experienced attorney can evaluate your case and advise whether professional legal help would benefit you.

Most personal injury attorneys offer free initial consultations and work on contingency—they only get paid if you recover compensation. This arrangement means quality legal help is accessible regardless of your financial situation. The increased settlement an attorney typically obtains far exceeds their fee.

How an Attorney Protects Your Interests

Personal injury attorneys handle all communication with insurance companies, preventing you from making damaging statements. They gather and preserve evidence, consult with medical experts, calculate the true value of your claim, and negotiate aggressively on your behalf.

If settlement negotiations fail, your attorney can file a lawsuit and represent you in court. Insurance companies settle more quickly and for higher amounts when they face an experienced attorney who’s prepared to litigate.

For Oregon accident victims, working with a local attorney who understands state-specific laws and local court systems provides additional advantages. They know how Oregon’s comparative negligence rules work, understand local insurance company tactics, and have relationships with local medical experts.

Conclusion

After a car accident, emotions run high—and it’s easy to make common mistakes after a car accident that can cost you down the line. From leaving the scene too early to settling too quickly, each mistake can significantly impact your ability to recover physically and financially. By staying calm, documenting everything thoroughly, seeking appropriate medical care, and getting qualified legal guidance when needed, you can protect your health, your finances, and your future.

The weeks and months following an accident are critical. Understanding what not to do is just as important as knowing the right steps to take. Don’t let preventable errors compound the trauma you’ve already experienced.

If you’ve been injured in a car accident in Oregon and want clarity about your options, Ryan Hilts Law offers compassionate, experienced legal guidance. With offices in Lake Oswego and Bend, Ryan Hilts has helped Oregonians navigate the aftermath of serious accidents for nearly two decades—providing honest advice and personalized attention every step of the way. Contact us today for a free consultation to discuss your case.

Frequently Asked Questions

Q: How long do I have to report a car accident to my insurance company in Oregon? A: You should report an accident to your insurance company as soon as possible, typically within 24-72 hours. Most insurance policies require “prompt” notification, and delays can result in claim denials. Even if you’re not sure whether you’ll file a claim, notify your insurer about the accident.

Q: Can I still receive compensation if I was partially at fault for the accident? A: Yes. Oregon follows a modified comparative negligence rule, which means you can recover compensation as long as you’re less than 51% at fault for the accident. However, your compensation will be reduced by your percentage of fault. For example, if you’re found 20% at fault, your settlement will be reduced by 20%.

Q: What should I do if the other driver doesn’t have insurance? A: If you’re hit by an uninsured driver, you can file a claim under your own uninsured motorist coverage if you have it. Oregon requires insurance companies to offer this coverage, though you can decline it in writing. If you don’t have uninsured motorist coverage, you may need to pursue compensation directly from the at-fault driver through a lawsuit.

Q: How much is my car accident claim worth? A: Claim value depends on multiple factors including medical expenses, lost wages, property damage, future medical needs, pain and suffering, and the severity of your injuries. Minor injury claims might settle for a few thousand dollars, while serious injuries can result in settlements worth hundreds of thousands or even millions. An experienced attorney can evaluate your specific case and provide a realistic estimate.

Q: Should I accept the first settlement offer from the insurance company? A: Generally, no. First settlement offers are typically lower than what your claim is worth. Insurance companies hope you’ll accept quickly before understanding your full damages. Before accepting any offer, ensure you’ve reached maximum medical improvement, understand all your losses, and ideally have consulted with an attorney who can advise whether the offer is fair.