Ridesharing companies like Uber and Lyft have revolutionized urban transportation. For many Oregonians, calling a ride via smartphone is second nature. Unfortunately, more time on the road also means more opportunities for crashes: the National Highway Traffic Safety Administration estimates there are nearly 10 million auto accidents each year. While most collisions involve private vehicles, accidents during rideshare trips raise unique legal questions.

Unlike a typical fender‑bender, rideshare incidents can involve multiple parties (the rideshare driver, a third‑party motorist, the rideshare company and various insurers). Oregon law requires all drivers to carry liability insurance, yet personal policies do not cover drivers while they are transporting passengers for hire. Passengers must rely on commercial insurance or their own uninsured/underinsured motorist coverage. With so many moving parts, injured riders often wonder whether to navigate the claim themselves or hire a legal professional.

This article uses five common signs to help you decide when it’s time to call a rideshare injury lawyer. If your claim is straightforward, with no injuries, minimal property damage, and clear acceptance of fault, handling the process yourself might suffice. But when injuries are serious or liability is contested, an attorney can preserve evidence, negotiate effectively and help you recover full compensation.

Also Read

- Oregon Car Collision Lawyer – Maximize Your Compensation After an Accident

- The Risk of Driving Without Auto Insurance

- Top Car Crash Lawyers – Maximize Your Compensation

TL;DR

If you’re hurt in a rideshare crash, stay calm, call 911 and gather as much information as possible (names, contact details, insurance information, photos and witness statements). The Insurance Information Institute stresses that an official police report and detailed documentation make the claims process easier. In simple cases with no injuries and clear fault, you might manage the claim yourself. However, you should contact a rideshare injury lawyer when you:

- Sustain moderate or severe injuries or face large medical bills.

- Encounter disputed or unclear liability, especially when multiple drivers or rideshare companies are involved.

- Face complicated insurance questions—personal coverage won’t apply while the driver is working and commercial policies have strict conditions.

- Experience delays, denials or lowball offers from insurance adjusters.

- Are approaching critical deadlines, such as Oregon’s two‑year statute of limitations for personal‑injury claims.

Key Takeaways

- You Don’t Always Need a Lawyer. Claims involving no injuries, minimal property damage and an admission of fault are often handled through insurance without legal help.

- Serious Injuries Warrant Representation. High medical bills, long‑term treatment or permanent disability are clear signs to consult a rideshare injury lawyer.

- Disputed Liability or Multiple Parties Requires Expertise. Rideshare crashes can involve several drivers and overlapping insurance policies—an attorney can untangle liability and preserve evidence.

- Insurance Tactics Can Undermine Your Claim. Adjusters may delay, deny or undervalue claims; legal counsel levels the playing field and ensures fair compensation.

- Statutes of Limitations and Deadlines Matter. Oregon generally allows two years to file personal‑injury lawsuits; missing a deadline may bar recovery.

When You Might Handle It Yourself

Not every rideshare accident requires a lawyer. In straightforward, low‑stakes cases, you may be able to manage the process without legal representation. Examples include:

- No injuries or minor bruising. If you only suffer minor aches and do not require medical treatment beyond a check‑up, your damages are limited and the insurer will likely offer a fair settlement.

- Property damage is minimal. If there is little or no damage to the vehicle, filing a claim for repairs may not require legal help.

- The at‑fault party admits liability. When the rideshare driver, another motorist or the rideshare company accepts responsibility, the claim is often straightforward.

- Cooperative insurance adjusters. If the insurer responds promptly and offers reimbursement for medical bills, lost wages and property damage, you may not need a lawyer.

Even in these situations, remain vigilant. Hidden injuries can emerge days after a crash, and early settlements may undervalue future expenses. If your condition worsens or the insurer’s offer seems low, consult an attorney before signing a release.

When You Might Need Legal Help

Sign 1 – Serious Injuries or High Medical Bills

The most compelling reason to hire a rideshare injury lawyer is significant injury. According to Oregon car‑accident attorneys, victims should seek legal counsel when accidents lead to high medical bills, severe injuries, long‑term care or permanent disabilities. Whiplash, traumatic brain injuries and spinal cord damage often develop slowly; some “silent injuries” become symptomatic days or weeks later. A lawyer ensures you receive proper medical evaluation, calculates long‑term costs and pursues compensation for pain and suffering.

Rideshare injury claims also involve Personal Injury Protection (PIP) and uninsured/underinsured motorist (UM/UIM) coverage. Oregon mandates PIP benefits, which provide no‑fault coverage for medical expenses and lost wages. However, PIP limits are often too low for serious injuries. An experienced attorney can coordinate PIP, health insurance and UM benefits to maximize recovery.

Bottom line: If you experience anything beyond minor scrapes—especially injuries that require hospitalization, surgery or ongoing therapy—consult a rideshare injury lawyer. They will assemble medical evidence, hire experts and negotiate with insurers to secure full compensation.

Sign 2 – Liability Is Disputed or Unclear

Liability in rideshare accidents is often murky. While private collisions usually involve two drivers, rideshare crashes may include multiple vehicles, passengers and commercial insurers. Fault may be disputed, and the responsible party can change depending on the rideshare driver’s app status.

The Oregon Division of Financial Regulation warns that personal auto policies do not cover drivers while they are transporting passengers for a fee. If a driver has their rideshare app off (Period 0), only personal insurance applies. When the app is on but no ride is accepted (Period 1), contingent commercial coverage with low limits may apply. Once a ride is accepted or a passenger is on board (Periods 2 and 3), Uber and Lyft provide up to $1 million in liability coverage; some companies also include UIM coverage.

Disputes often arise over when the crash occurred, whether the driver was logged into the app and which policy applies. In some cases, multiple parties share fault under Oregon’s comparative negligence rules. Gathering evidence—such as driver app logs, vehicle data and witness statements—requires rapid action. A rideshare injury lawyer can subpoena records, work with accident reconstructionists and build a strong case proving liability.

Red flag: If any party disputes who caused the crash or if more than two vehicles are involved, consult an attorney. Proving fault is critical in Oregon because your compensation may be reduced by your percentage of fault.

Sign 3 – Insurance Coverage Gets Complicated

Even when liability is clear, insurance coverage for rideshare accidents is notoriously complex. Personal auto insurance doesn’t cover rideshare drivers when they’re working; passengers cannot rely on their driver’s personal policy. Instead, riders must recover from the rideshare company’s commercial policy—provided the driver was logged in and working. Coverage amounts vary by period:

- Period 0 (app off): Only the driver’s personal insurance applies, often with minimal limits.

- Period 1 (app on, waiting for a ride): Uber and Lyft provide contingent liability coverage (about $50,000 per person for bodily injury, $100,000 per crash and $25,000 for property damage).

- Periods 2 and 3 (ride accepted and passenger on board): Uber and Lyft supply up to $1 million in third‑party liability coverage and may also provide UM/UIM coverage.

Understanding which policy applies, the coverage limits, and how to file under multiple policies can be daunting. Insurance adjusters may attempt to shift responsibility onto another insurer or argue that the period limits liability. A rideshare injury lawyer can identify all available coverage, ensure timely notice to each insurer and negotiate to maximize benefits.

When to act: If you’re unsure which policy should cover your losses—or if you receive contradictory information from insurers—speak with an attorney. They can unravel policy language, coordinate coverage and protect your rights.

Sign 4 – Insurance Adjusters Delay, Deny or Undervalue Claims

Insurance companies are for‑profit businesses. Even with clear liability and documented injuries, adjusters often minimize payouts. Some common tactics include:

- Offering a quick but low settlement. Adjusters know that injured victims may be under financial pressure. Early offers often fail to cover future medical expenses or lost wages.

- Delaying payment. Requests for unnecessary documentation or repeated investigations can drag out a claim, hoping you’ll settle for less.

- Requesting recorded statements. Anything you say may be used to undermine your claim or argue that your injuries were not caused by the crash.

Legal guides advise that you should hire a lawyer if you’re injured, need help proving fault or are struggling with an insurance company. Attorneys are familiar with insurance tactics and can counter delay strategies, calculate damages accurately and demand fair compensation. They also handle communications, protecting you from inadvertently harming your case.

Tip: Never sign a release or give a recorded statement without consulting a rideshare injury lawyer. Representation can significantly increase your settlement and ensure your rights are respected.

Sign 5 – Important Deadlines or Legal Complexity

Personal‑injury claims are governed by strict deadlines. In Oregon, injured parties generally have two years from the date of the crash to file a lawsuit. If the rideshare driver is a public employee (e.g., a publicly funded transit service), a notice of claim may be required within 180 days. Evidence collection also has time limits: dash‑cam footage, app data and surveillance videos can be erased or overwritten quickly.

Additionally, many insurance policies require prompt notice—some within 30 days—to preserve coverage. Failing to report an accident to Uber or Lyft’s insurer within their specified time frame can jeopardize your claim. The Oregon Division of Financial Regulation advises drivers to ask the transportation company about its coverage before riding and to discuss options with their own insurer.

Rideshare accidents may also implicate state rideshare regulations, federal safety standards or local ordinances. Navigating these laws requires legal knowledge. If you’re approaching a deadline or uncertain about procedural requirements, contacting an attorney early can prevent costly mistakes.

Procrastination hurts: Waiting too long to consult a lawyer can result in missed deadlines, lost evidence and reduced compensation. It’s better to seek guidance early and decide whether to proceed alone after understanding the risks.

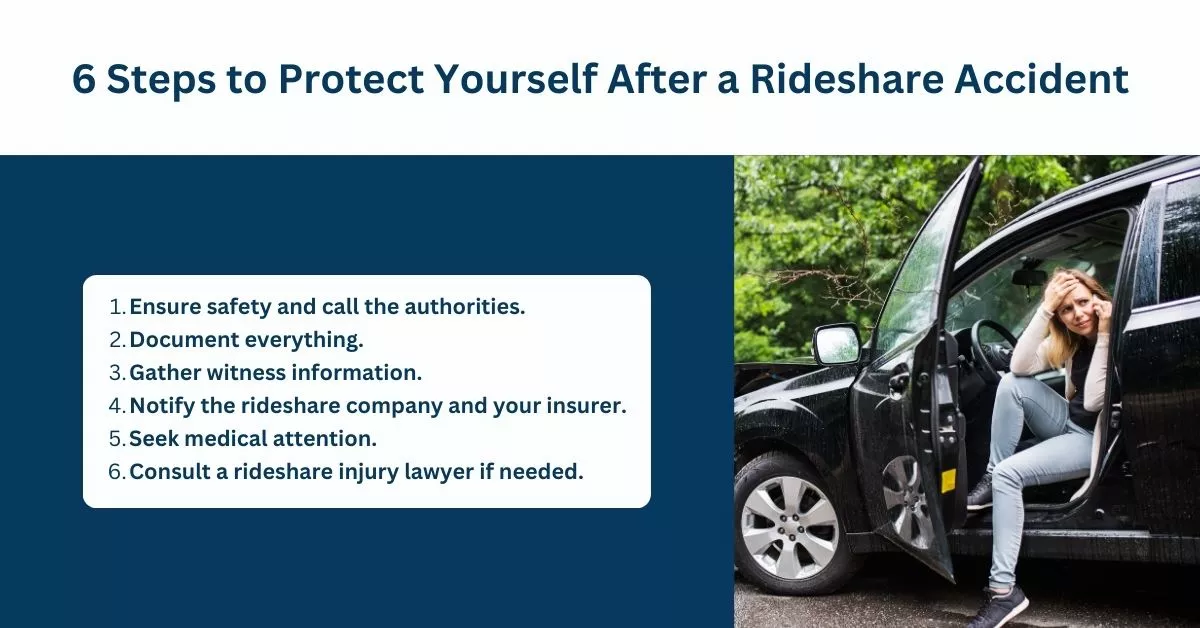

6 Steps to Protect Yourself After a Rideshare Accident

Knowing what to do immediately after a rideshare crash can preserve your health and strengthen your claim. Follow these steps:

- Ensure safety and call the authorities. Move to a safe location if possible and check for injuries. Call 911 and report the accident. The Insurance Information Institute notes that having an official police report can simplify the claims process.

- Document everything. Use your smartphone to photograph vehicle damage, road conditions, license plates and any visible injuries. Write down the time, weather conditions and sequence of events. Get names, phone numbers and insurance details from all drivers, including the rideshare driver’s app status and company.

- Gather witness information. Independent witnesses can corroborate your account if liability is contested.

- Notify the rideshare company and your insurer promptly. Report the crash through the rideshare app and call your own insurance agent. Provide basic facts without admitting fault or speculating about injuries.

- Seek medical attention. Visit a doctor or emergency room even if you feel fine; some injuries take time to manifest. Medical records link your injuries to the crash and support your claim.

- Consult a rideshare injury lawyer if needed. If any of the five signs described above apply, legal counsel can preserve evidence, navigate insurance complexities and fight for a fair outcome.

Conclusion

Rideshare accidents aren’t always as straightforward as they seem. While minor collisions with no injuries may be resolved without legal help, many cases involve hidden injuries, disputed liability, complex insurance layers and critical deadlines. Oregon law requires drivers to carry insurance, but personal policies don’t cover commercial rideshare activity, and passengers can be left navigating unfamiliar territory.

When serious injuries, contested fault, insurance tactics or legal complexities arise, contacting a rideshare injury lawyer can mean the difference between a minimal payout and full compensation for your losses.

If you’ve been hurt in a rideshare crash in Oregon, Ryan Hilts Law offers compassionate and experienced representation. Our team understands how to investigate rideshare accidents, identify all sources of insurance and negotiate with large corporations.

Contact us today for a free consultation and learn how we can help you recover the compensation you deserve. We’re here to guide you through every step—from filing claims to pursuing litigation—so you can focus on healing.

Frequently Asked Questions

- Do I really need a lawyer for every rideshare accident?

Not necessarily. If no one is injured, property damage is minor and liability is uncontested, you may manage the claim yourself. However, when injuries are present, liability is disputed or the insurance process becomes complex, a rideshare injury lawyer can protect your rights and increase compensation. - Does my personal auto policy cover me as a rideshare passenger?

No. According to Oregon’s Division of Financial Regulation, neither your personal auto policy nor the driver’s personal policy will protect you when you are riding in a vehicle for hire. Passengers must rely on the rideshare company’s commercial insurance or their own UM/UIM coverage. - How long do I have to file a rideshare injury claim in Oregon?

Generally, you have two years from the date of the crash to file a personal‑injury lawsuit. Insurance policies may require notice within 30 days, and government defendants (e.g., public transportation agencies) have shorter notice periods. Consulting a lawyer early ensures you meet all deadlines. - What if the rideshare driver’s app was off during the crash?

When a driver is off the rideshare app (Period 0), only their personal auto insurance applies. If the driver has minimal coverage or no coverage, recovering damages may be more difficult. A rideshare injury lawyer can determine whether other policies apply and pursue compensation from all liable parties. - Will hiring a lawyer increase my compensation?

Studies show that represented accident victims typically secure higher settlements than those who go it alone. Lawyers understand insurance tactics, gather evidence to prove liability, calculate future medical needs and negotiate aggressively. Even after attorney’s fees, many clients recover more than they would without representation.